Exploring Innovation, Compliance, and Strategic Growth in the Evolving Tax Landscape

Our Partners

SUMMARY OF THE EVENT

In the current business climate, organisations are facing profound changes driven by technological progress, evolving regulations, and fluctuating economic conditions. Tax and finance leaders must now undertake a comprehensive reevaluation of their strategies to adapt to these shifts. Key trends, including the rise of digital currencies, increasing emphasis on sustainability, and major global tax reforms, are transforming the landscape of taxation. To navigate these changes effectively, leader must stay ahead of emerging trends to ensure compliance, enhance efficiency, and support strategic growth.

As technology becomes increasingly embedded in business practices, the future of taxation is increasingly intertwined with digital advancements. The shift towards real-time, data-driven methodologies has become the norm, pushing companies to quickly address risks and manage costs. Additionally, adapting to changing government regulations and economic factors, both internal and external, adds layers of complexity. Tax leaders must adopt a forward-thinking approach to manage these challenges and align with both regulatory demands and economic realities.

The Smart Future of Taxation Summit & Awards 2024 provides a platform of learning from senior industry professionals and experts. Attendees will gain insights into cutting-edge strategies, technological advancements, and evolving regulatory changes through keynotes, panels, and interactive sessions. The summit offers a valuable opportunity to explore innovative approaches and stay ahead in the rapidly changing field of taxation, driving excellence and strategic growth.

Who should Attend?

CXOs, Presidents, Directors, Gms Heads & Executives of:

Taxation

Finance

Accounting

Corporate Tax

Direct & Indirect Tax

Auditing

Merger & Acquisition

Transfer Pricing

Compliance

Litigation

GST

Digital Transformation

Featured Speaker

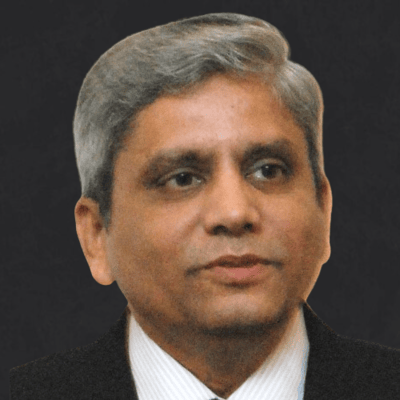

Rajesh Kasargod

Head Controller- Group Financial Reporting/ Insurance / Direct Taxation

Blue Star Limited

Industry Focus

Why you Should Attend?

Stay Ahead of Trends:

Gain insights into the latest tax trends, technological advancements, and regulatory changes shaping the future of taxation.

Learn from Experts:

: Engage with senior industry professionals and experts through keynotes, panel discussions, and interactive sessions.

Strategic Growth:

Discover cutting-edge strategies to enhance compliance, efficiency, and strategic growth within your organisation

Networking Opportunities:

Connect with peers, industry leaders, and potential partners to share knowledge and build valuable professional relationships

Innovative Solutions:

: Explore the latest innovations in tax technology and learn how to implement them in your organisation to stay competitive.

Comprehensive Knowledge:

Stay updated on the evolving tax landscape, including digital currencies, sustainability initiatives, and global tax reforms.

Actionable Insights:

Leave with practical takeaways and actionable insights that can be immediately applied to improve your tax strategies and operations.

Awards 2024

Individual Categories

Chief Tax Officer of the Year

Register Now

Tax Leader of the Year

Register Now

Emerging Leader in Tax

Register Now

Innovative Leadership in Tax Strategy

Register Now

Excellence in Tax Leadership

Register Now

Global Tax Leadership Award

Register Now

Leadership in Corporate Tax Compliance

Register Now

Outstanding Contribution to Tax Leadership

Register Now

Leadership in Tax Technology Implementation

Register Now

Transformative Leadership in Tax Reform

Register Now

Leadership in Tax Risk Management

Register Now

Leadership in Sustainable Tax Practices

Register Now

Leadership in International Taxation

Register Now

Leadership in Transfer Pricing

Register Now

Leadership in Indirect Taxation

Register Now

Leadership in Digital Taxation

Register Now

Emerging Leader in Digital Business trandformation Solutions

Register NowOrganisation Categories

Excellence in Tax Compliance

Register Now

Innovation in Tax Planning

Register Now

Outstanding Achievement in Transfer Pricing

Register Now

Best Use of Tax Technology

Register Now

Tax Risk Management Excellence

Register Now

Excellence in Global Taxation

Register Now

Excellence in Indirect Taxation

Register Now

Best Tax Team of the Year

Register Now

Outstanding Contribution to Tax Policy

Register Now

Excellence in Financial Reporting

Register Now

Best Corporate Finance Strategy

Register Now

Innovation in Financial Management

Register Now

Excellence in Mergers & Acquisitions

Register Now

Best Financial Transformation Initiative

Register Now

Outstanding Achievement in Corporate Finance

Register Now

Best Financial Risk Management

Register Now

Excellence in Financial Planning & Analysis

Register Now

Best Use of Data Analytics in Finance

Register Now

Outstanding Contribution to Financial Governance

Register Now

Excellence in Treasury Management

Register Now

Best Practices in Corporate Finance

Register Now

Best Use of AI in Tax Compliance

Register Now

Excellence in Digitisation of Tax Processes

Register Now

Innovative AI Solutions in Tax Management

Register Now

Best Digital Transformation in Tax

Register Now

Excellence in Tax Automation

Register Now

Excellence in Digital Tax Reporting

Register Now

Best AI-Powered Tax Risk Management

Register Now

Excellence in Digital Tax Governance

Register Now